One of the world’s largest credit rating agencies doubled down on its Canadian home price forecast. Moody’s Analytics sent clients its September update on Canadian real estate prices. The forecast reiterates they expect price declines to begin towards the end of this year. The report also names impacted cities this time, with Toronto expected to be a leader lower.

Forecast Vintages

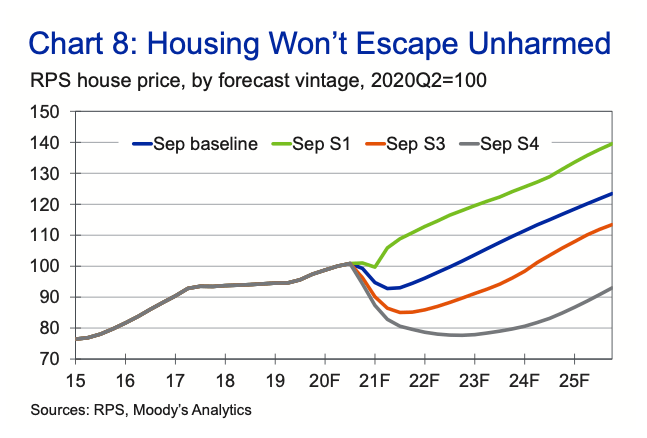

A quick note on reading Moody’s charts, which includes “forecast vintages.” If you’ve only looked at consumer forecasts, these might be new. They’re scenarios that vary depending on the forecasting model’s inputs. Instead of giving a forecast like, “prices will drop x%,” they give a range based on factors. These factors are fundamentals that have typically supported prices.

The Moody’s forecast shows vintages as baseline, S1, S3, and S4. The September baseline is the scenario they believe has the highest probability. The S1 is what happens if indicators are better than expected. This would mean unemployment drops fast, and disposable income doesn’t fall much. The S3 is what happens if fundamentals are worse than expected. S4 is the worst scenario that can unfold in a reasonable amount of time. Abrupt scenarios and black swans can still be worse. It’s just those are outside of the range of reasonable expectations.

Canadian Real Estate Markets To Start Showing Weaknesses Soon

Moody’s previous forecast didn’t expect the market to show signs of weakness until Q3, and they’re doubling down. The report’s economist expects stimulus, mortgage deferrals, and interest rates to contain damage until Q3. They expect by Q3, the optimism of those programs will begin to wear thin. The reality of how meaningful the improvements are, should be apparent by then. The optimism should then fade. It’s at this point they believe prices can no longer defy employment, vacancy, and delinquency rates.

Canadian Real Estate Prices To Drop Around 7%

The firm expects all scenarios to show a drop in the near future, but how much depends on fundamentals. In the September baseline, the firm’s economist is forecasting a ~7% decline at the national level. This scenario expects unemployment at 8.56%, and a 2% drop of disposable income next year. Since the rise in disposable income was due to temporary supports, the fall is expected.

In the other scenarios, things vary from a brief drop to a very deep, multi-year decline. In the S1 scenario, there’s only a brief dip in Q1, before prices rocket even faster and higher. In S3, a slightly worse than base case, prices fall about 15%, taking them back to 2016 levels. In S4, if disposable income, GDP, and/or unemployment worsen, prices drop about 22%, back to 2015 levels. Of course, this trend isn’t evenly distributed across Canada. However, it’s also not distributed how most might expect.

Prairie Cities and Toronto Real Estate To Lead The Declines

The base case sees Prairie cities and Toronto real estate leading price declines. Calgary, Edmonton, and Regina lead the drop, with a peak-to-trough decline between 9 to 10%. This is a trend already apparent in the regions’ condo markets. Toronto, a little more unexpected, is forecasted to see a 9% price drop, from peak to trough. Vancouver’s drop is forecasted below the national average, with an average decline of almost 7%. The last market is interesting, since other organizations gave Vancouver much worse forecasts.

Toronto Real Estate To Experience Uneven Declines Across Regions

The base case for Toronto expects an uneven decline, with some regions harder hit. The drop across Toronto CMA is expected to be about 9%, from peak to trough. Pickering should see smaller declines, but experience minimal growth through 2025. Markham is the most surprising though, not expected to hit 2017 highs by 2025. The trend here appears to be regions short on space will recover the fastest. Although that is likely to depend on the type of housing as well.

The forecast notes pandemic uncertainty, and its potential to bring greater downside. As it gets colder, the potential of more indoor activity may lead to a second wave. The report’s economist believes this can bring even larger declines to prices. Shifting consumer behavior is also a wild card that can also push prices lower, as are any vaccine delays.

Like this post? Like us on Facebook for the next one in your feed.

They can’t drop until next year. One thing people aren’t talking about is how quickly markets adjust to stimulus. It absorbs it, and it’s the new normal. Tapering to normal becomes downside, and leads to “taper tantrum.”

I agree. Populism, regardless of left or right, leads to making decisions for immediate satisfaction, and ignores long-term sustainability. I’m already surprised they extended the wage subsidies until mid-2021.

I think the the thing that needs to be talked about more is people that *needed* a mortgage deferral, will be stuck in their home for as long as possible, before selling.

>I think the the thing that needs to be talked about more is people that *needed* a mortgage deferral, will be stuck in their home for as long as possible, before selling.<

Those with crushing mortgage debt will hang on until all other avenues are exhausted. They would be wise to exit now, but they won’t.

The investors that can afford to get out will beat the stampede.

All others will learn the lesson of how inefficient markets tend to fool the uninformed.

How about “changing” the CERB into CRB and extending that until September 2021. I really underestimated this governments ability to pay people’s mortgages.

exactly. let’s be honest this country sold itself a long time ago, and has no other option at this point but to keep indulging its private + public debt. world markets won’t ignore that though – CAD future is likely dim.

You should really turn last week’s webinar into an article.

For those that missed it, Steve explained Keynes’ argument that persistently low rates lose the desired effect. Same applies to stimulus. The longer stimulus is in place, the lower the life curve, and the more is needed for less and less effect.

Is there a link to this webinar? Sounds interesting.

Did moody take into account political corruption to prop up real estate? Toronto’s real estate has long been detached from fundamentals, its only survives with government interference. For example the blanket mortgage deferrals, people with more than 1 real estate should not be allowed to defer their payments.

>Did moody take into account political corruption to prop up real estate?<

The interesting thing that is overlooked is that the ones who are benefiting from the manufactured bubble are renters of their ill-gotten gains.

The paper wealth is only temporary because it is propped up by the politicians who will inevitably have to succumb to the winds of political change as well as the fundamentals that will catch up to the market.

It is a bubble, and it will pop.

Q; How long will it takes for average family with $83000 income if they save %10 of their income each year to save a $200,000 deposit for %20 down and 40000 land transfer fee to purchase a house in Toronto?

This would encourage home owners to purchase a second or third home.Some may file for bankruptcy with all its attendant benefits.

I am about to buy a house in a small town called Princeton in BC (3 hrs from Vancouver). There is lots of work here due to a mine, 3 mills, and a legal marijuana grow-op. Is there anyone out there who can guess whether the market here will also plummet? Rentals are in super high demand since there is a total lack of housing. I would hate to pull out now, but reading this article is freaking me out. However, it is hard to get info on small towns. All articles tend to talk only about cities. Accepted price is just $350K (already down $25K from asking price)… but if I could get it for even lower then that would obviously be better. I know this is small beans but it’s still a major decision for me! Any thoughts or advicegreatly appreciated 🙂