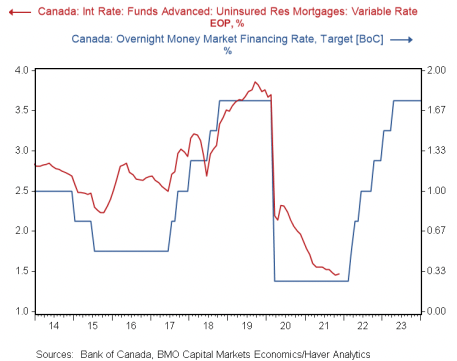

Canadian real estate prices are likely to get a bit of a chill by the end of the year. BMO believes the surge in home prices at the end of 2021 was due to a low overnight rate, which failed to move with the bond market. As a result, rising fixed income mortgages showed little impact as buyers switched to variable rate mortgages. Escaping that is going to be more difficult with the Bank of Canada (BoC) forecast to raise the overnight rate. BMO sees the rate hike producing a re-pricing of the market, though they don’t expect an extreme one.

Canadian Variable Mortgage Rates Will Rise At Least 100 BPS

Canada’s bond market is screaming for higher mortgage rates. The bank estimates over the next year, five-year fixed rate mortgages could “easily” add at least 50 basis points (bps). “On the variable side, 100 bps or more of BoC tightening is in the cards over the course of this year,” wrote BMO economist Roberty Kavcic to capital markets customers.

In 2021, Government of Canada (GoC) bond yields climbed which should have throttled credit. The BOC’s lack of action on the overnight rate, allowed credit demand to shift to variable rates. As a result, variable rate debt, usually a small part of the market, became the majority of debt issues for uninsured mortgages.

“For housing, the shift into lower-rate variable mortgages in 2021 kept the fire going, but the market will no longer be able to hide from higher rates this year,” he warned.

The bank estimates home prices are based on a weighted-average mortgage rate of 1.8% at the end of 2021. With inflation at its current level, these are deeply negative loans in real terms. BMO thinks this is coming to an end in 2022.

Canadian Real Estate Prices Will Have To Reprice For Higher Rates

BMO estimates if mortgage rates follow the above estimate, home prices will be priced on significantly higher rates. The market will be priced at a weighted-average of 2.7% by the end of this year, which our ballpark estimate is a 10% drop in credit issuance. “Incomes will grow too but, all else equal, it will be hard for prices to keep powering through that given where valuations already are,” warns the bank.

Canadian Fixed Rate Mortgages

Accounting for a 3% increase in household income, the 10% drop works out to around a 7.25% drop in mortgage credit. That doesn’t mean home prices will drop by that much, but it influences behavior. People tend to rush into the market when home prices rise, and hold onto inventory longer — like we’re seeing right now. Conversely, households also tend to see pull back on buying, and list inventory when they see falling home price growth. When a market disregards fundamentals, it’s all based on emotions.

Canadian Variable Rate Mortgages

Greater Toronto Real Estate Showed What A Small Reprice Looks Like

The economist points to the Greater Toronto real estate market as a recent example of this reaction. Interest rates, amongst other measures, hit the market in 2017-2018. “… a frothy market absorbed such a shift (hint: there was a small correction and stagnation, but not a serious melt),” he ends.

At a high level, Greater Toronto’s composite benchmark price only fell an inflation adjusted 10% from peak to trough. Different segments varied though, with condo apartments only falling 2.09% across the region. Detached homes fell a much larger 12.9% from peak to though, with the average price falling 24.52% from peak to trough. Of course, no one remembers this except for the people who couldn’t close on financing at the time — especially if they were sued for failing to close, and had to pay for the price drop.

Higher interest rates will surely prick the BUBBLE… how far it falls is anyone’s guess- but it will fall!

Those that are highly leverage will find when they need to sell there is no one to sell to.

The prices are super inflated and people are buying from fomo. We know what happened with Gold, crypto as well as the stock market with fomo buying. We’ll see what happens to the housing market when the interest rates go up too.