Global real estate is entering a downturn that will kill growth, and it’s the worst in Canada. That was the gist of numbers from Oxford Economics today. The macro-research firm crunched the numbers on housing as a share of GDP, and Canada had the highest share. As home sales and building slows, this will leave the economy with the slowest share of growth.

A Global Housing Slump Will Kill Economic Growth Everywhere

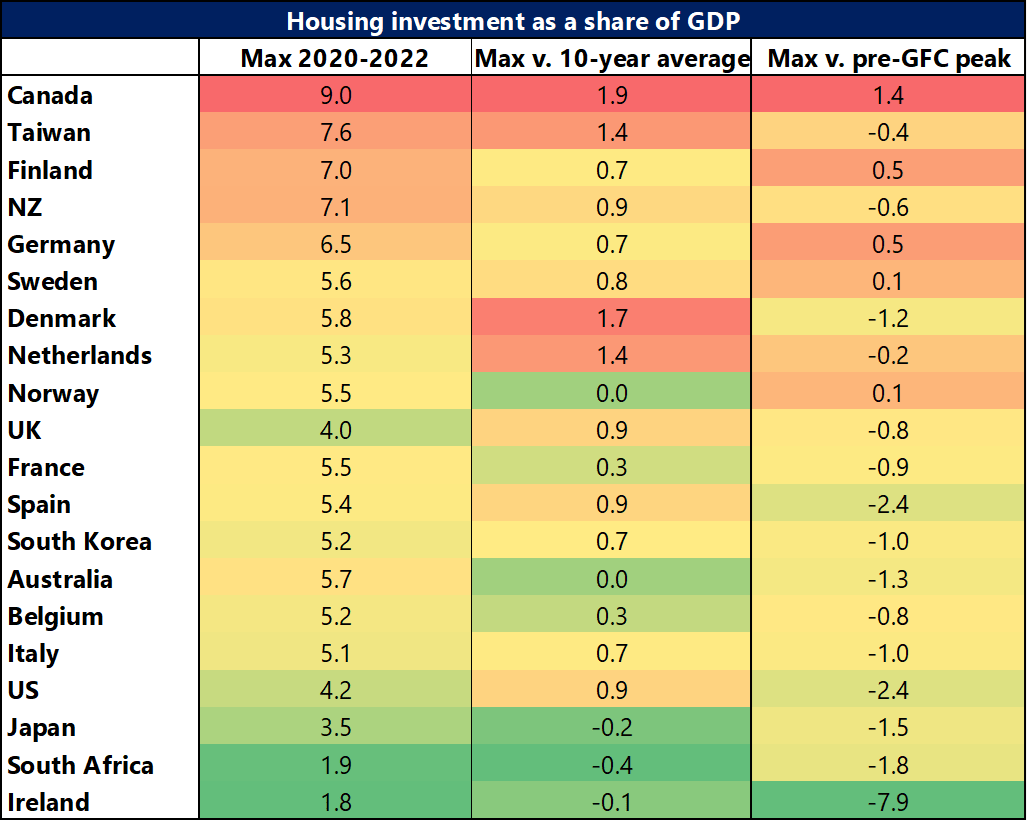

Oxford Economics sees a global economic slump coming. They blame a negative wealth effect, falling residential investment, and tighter credit. Countries with the largest share of housing investment will see the biggest impact.

“If we rank each economy according to these three factors and average the ranks, the most vulnerable economies look to be Canada, Taiwan, Finland, and New Zealand,” said Adam Slater, a lead economist with the firm.

Canada Is The Most Vulnerable Economy Due To Its Real Estate Addiction

Canada is more addicted to housing investment than any other economy. Residential investment peaked at 9.0% of GDP from 2020 to 2022, the highest share in the world. In a distant second is Taiwan (7.6% of GDP), followed by Finland (7.0%), and New Zealand (7.1%). It’s significant when almost 1 in 10 dollars of an economy’s output is just sheltering people.

Source: Oxford Economics.

The same monetary policy mistakes were echoed around the world, but not all economies are in a bad place. Notable exceptions to housing dependence are Japan (3.5%), the US (4.2%), and Italy (5.1%). “Here, housing investment as a share of GDP is below average for the sample, well below pre-GFC peak levels, and in the case of Japan also lower than the 10-year average,” said Slater.

Canada’s combination of highly indebted households and housing investment are a problematic combination. As interest rates rise, households won’t be able to continue absorbing home prices as easily. Demand falls until prices drop, having a disproportionate impact on GDP.

Just when you thought real estate was a great option to attract investors (national and International), the rug has been pulled out from beneath their feet. Unfortunately, legitimate taxpayers contributing to GDP via other means other than real estate just want a roof over their heads.

Better Dwelling needs Like Button!

Canadians are dumbest when around a local realtor.

Get on zillow or redfin and buy your cheap American rental homes direct. Have them bring in American rent dollars for the rest of your life. Wake up and smell the coffee.

“Don’t believe the hype

Don’t, don’t, don’t, don’t believe the hype

Don’t, don’t, don’t, don’t believe the hype….”

Whenever people tried to sell me on BitCoin, overpriced Real Estate investments or Pump ‘n Dump Stocks… or other sure fire money making strategies… I always recalled those immortal lyrics by Public Enemy. Maybe I’m poorer; maybe I’m richer; because of that. But at least I’m not tossing and turning nights like someone with 7 mortgages.

Chances are anyone who bought a place to live in just to live in will be okay.

“It’s significant when almost 1 in 10 dollars of an economy’s output is just sheltering people.” I’m not sure how many homes in the GTA & Vancouver have as their primary purpose the sheltering of people.