Most Canadian households are shying away from new credit, as higher interest rates lower incentive. Though there remains an exception, according to new data from TransUnion. The credit reporting giant found that new account growth for every type of credit fell in 2022, with credit cards being the exception. That trend may be problematic when combined with another insight from the agency—the demographics with the highest growth also happen to be the ones with the worst credit scores.

Canadians Are Pausing On New Mortgages, But Getting New Credit Cards

Canada’s climbing interest rates may be deterring borrowers from taking out new credit. Mortgages are the largest source of outstanding credit, but new originations fell by 32% in 2022. Fewer new accounts were seen nearly across the board, with originations dropping for personal loans (-16%), line of credit (-17%), and auto loans (-3%).

Only one major credit segment showed positive growth—credit cards. New credit card accounts grew 20% in 2022, which is impressive growth.

Canada’s Subprime Borrowers Are Back, and One of the Fastest Growing Segments of Borrowers

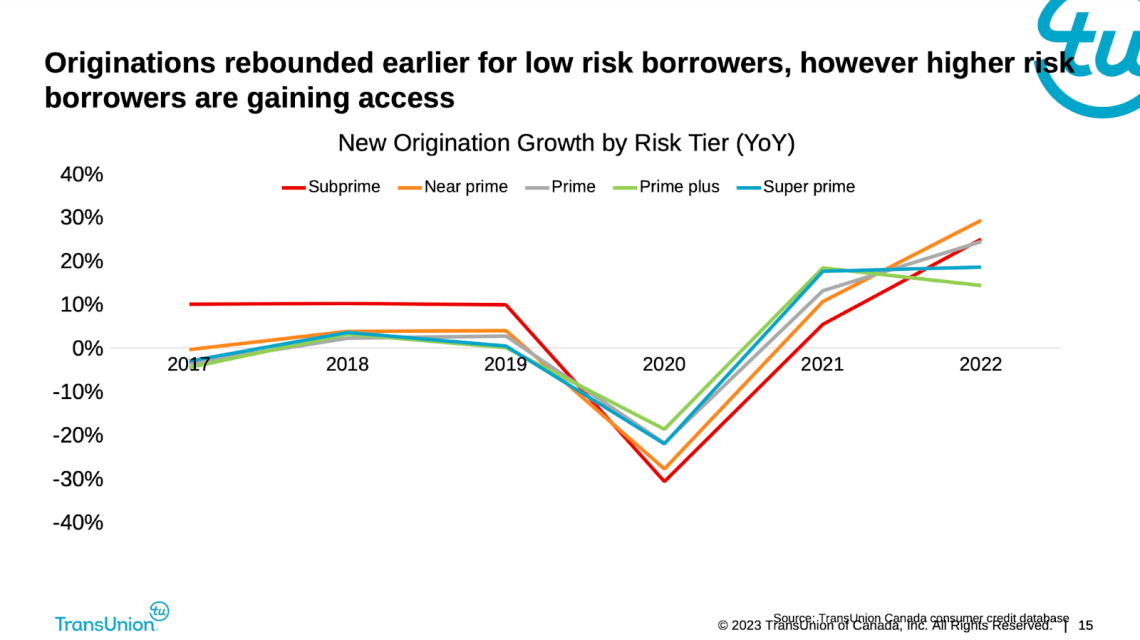

The fastest growth in new credit accounts is coming from a less-than-ideal market. Near prime, which is poor quality, but not the worst, was the largest growth segment in 2022. Followed by subprime borrowers, which represent the worst quality borrowers.

As the chart above shows, subprime credit took a big break in 2020, showing the sharpest contraction for new originations. This was due to a combination of fewer lenders willing to take a risk, and losing out to higher quality completion for loans.

Now that higher quality borrowers have peaked, lenders appear to be more comfortable taking on lower quality borrowers. It’s likely still a very small share of borrowers, but remarkably it’s growing at nearly twice the rate of originations for prime plus borrowers. That means the quantity of accounts can catch up really fast.

What does that tell you about the dire situation this garbage of a government has put the people in.

People are now despite that they’re all resorting to credit cards for financial help. The MSM tells you everything is just fine and dandy. 🤡

I work at a financial institution. People open a business account and expect to be provided a business credit card by default. Ive seen it being done by the big banks before. Once, I had a client whose credit application was declined but wanted to make a complaint to none less than the banks CEO. I let the gentleman know that credit was not a universal right.

Ray is 100% correct

The most garbage part of this government is inactivity in allowing banks to do whatever they like to shore up massively inflated housing valuations. And the amount of immigration is a head scratcher. No problem with the people immigrating. A national housing crisis seems an odd time to invite so many people over.