Canadian real estate prices are soaring, but the fastest growth is not coming from big cities. BMO chief economist Douglas Porter tells clients to really think hard about this growth. Home prices are now rising even faster than at the peak of the 1980s real estate bubble. Most of that growth isn’t coming from emerging global hubs, but small towns. He asks investors to consider: Do all small towns have supply shortages? Or is the madness of the crowd taking over?

Canadian Real Estate Prices Show Record Growth

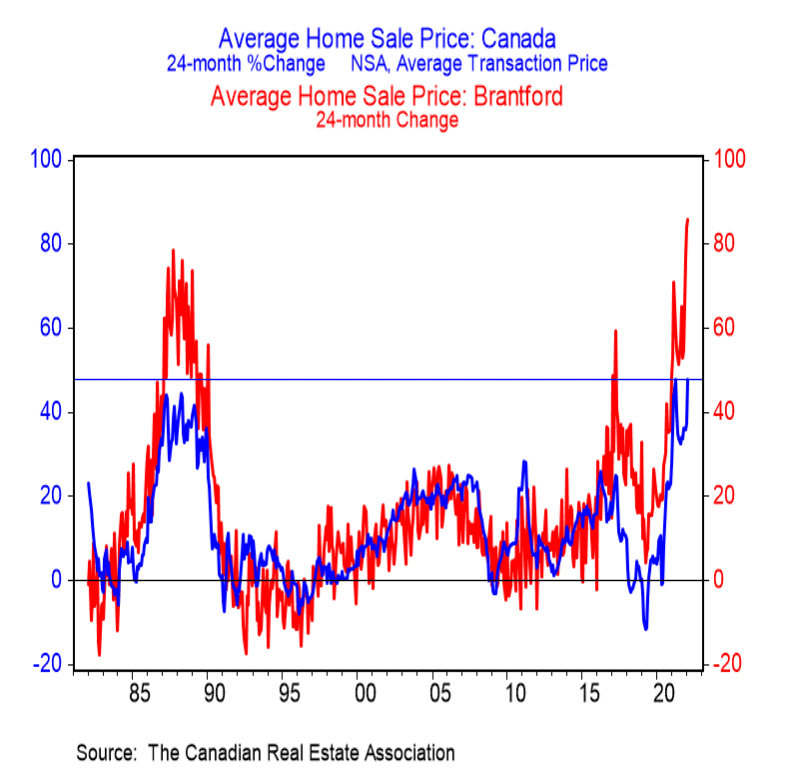

Canadian real estate prices are rising at a record rate, dismissing more supply and higher rates. Annual growth of the CREA benchmark price reached 28% in January 2022, the record for the index. It’s not just a base-effect either, says the bank, with prices up 46.4% since January 2020. Most of this growth also isn’t occurring in emerging global hubs, but small cities in the country.

Canada’s Late ’80s Real Estate Bubble Was Smaller

The CREA HPI only goes back to 2000, so there might be questions about how it compares to the ‘80s bubble. For that, BMO has to use the average transaction price from land registries. “… But even on the somewhat more volatile average transaction price measure, where records go back to 1980, the two-year gain is also a record-hot 48%,” says Porter.

Adding, “In other words, the Canadian housing market has just seen bigger increases than ever witnessed through any two years of the great housing bubble of the late 1980s. Just as a reminder, that episode ultimately saw the overnight rate climb to 14% to quell inflation and bring the market to heel. Prices then went into the wilderness for a decade.”

Those unfamiliar with interest rates might think a 14% climb to be impossible. However, the impact of interest rates is dependent on the sensitivity of the debt. A highly indebted population can see a similar impact with a smaller increase in rates.

If you think it’s different this time due to population growth, one should consider the pace in the 80s. At the height of the late-80s real estate bubble, population growth outpaced today’s recent cycle peak. In 1989, the population growth rate was more than a quarter larger than the 2018-2019 peak. It turns out immigrants stop moving to a place when the value proposition collapses. Shocker, I know.

Is Canadian Real Estate Driven By Madness or Supply?

Greater Toronto has a gross domestic product (GDP) bigger than most of Canada’s provinces. Steep price growth is arguably justifiable if you’re convinced it’s the next Manhattan. Even if the Government says it’s largely overvalued. However, that’s not where most of the growth has occurred — it’s happening in small cities. These aren’t international hubs, but relatively unknown places to global investors.

“Some of the wildest markets in the country remain smaller and medium-sized cities in Ontario. Not to pick on Brantford, but that fine city—previously known mostly as the home of Wayne Gretzky—has seen prices rocket 86% in two short years,” highlights the bank.

A similar trend can be seen across Ontario’s “cottage country,” where prices rose the fastest. BMO cites Barrie, Welland, Tillsonburg, Woodstock, Chatham, and Guelph as further examples. These are all charming places that might be future global hubs at some point. However, they’re closing the gap between Toronto so fast, they might be killing growth pre-maturely.

The bank rhetorically asks, “Do you seriously believe that each and every one of these smaller centers suddenly suffers from a supply shortage, or could it possibly be that a common demand factor is driving the madness across the entire region?”

Neighbor asked me to go halves with him on a pre-construction (I didn’t). His plan was to buy it and sell it before it was built, “make a quick buck.” It gets completed, still hasn’t sold.

Not renting it because he thinks he’s going to sell it soon, but he “doesn’t want to leave money on the table.”

Guy can barely afford his 10 year old Civic but he’s a real estate investment genius.

Why do people leave homes empty when they can just rent them out in the meantime? Even if you only rent it for a few months they’re the next person’s problem when you sell it.

This is a point most people can’t seem to get past. You know how a home staged ends up fetching a lot more? It’s the exact opposite of renters. It’s like it was unstaged, especially when it’s a house broken up into 4-5 units.

Not likely the situation with a new build renter but because tenants don’t own the place they won’t spend a lot on the furnishings or even do some of the basic stuff you might expect like hang a tv properly.

Own a home, rent it out… at some point you will understand.

If you get a troubled tenant, it would be better leaving it empty.. they ruin it for everyone and there are many of them.

Plus maybe the owner wants to enjoy it while not away somewhere else.

BMO has been on the ball. You should have incorporated these into the piece, because it’s a really fragmented case that makes a lot of sense once you see it.

Just the excess demand from the BoC makes real estate sales 6% of GDP. Absolute insanity.

– https://betterdwelling.com/canada-goes-all-in-on-real-estate-with-excess-home-sales-hitting-6-of-gdp-bmo/

Per Capital real estate transactions now running at double usual rate, clearly unsustainable

– https://betterdwelling.com/canadian-real-estate-doesnt-have-a-supply-problem-its-a-demand-issue-bmo/

Supply growing faster than population for the past 5 years:

– https://betterdwelling.com/canadian-housing-grew-faster-than-population-speculative-mindset-building-bmo/

No one sells when they’re making money. Everyone tries to sell when it stops.

– https://betterdwelling.com/canadian-real-estate-resembles-80s-bubble-higher-rates-to-solve-supply-issue-bmo/

every one of these articles are from better dwelling. where are other sources and citation?

Try springing for a subscription to Bloomberg . Similar takes behind the paywall, BD is the only news orgs that pays for the reports and then makes the memo’s key points free.

These are all better dwelling articles. So you have any other sources or citations?

And why does better dwelling keep deleting my posts?

It looks like it’s because you changed your name and then asked the same question. I doubt they’re sitting and waiting to block your comments in real time. WordPress or Akamai or whatever they use probably throttled you as suspicious since cosplaying as different people is, well, suspicious.

I agree.

Many issues are being ignored by the government. Monet laundering, investors and vacant homes are a few that need to be acted upon more severely. Theses 3 issues have caused the rise in prices more than anything else.

Oh, and let’s not forget about non – resident buyers that have bought far more than reported. The government has not kept it’s promise to put a 2 year moratorium on foreign buyers.

agent bob

Brantford is the next Manhattan. So is Tillsonburg. And all the Canadian cities. Linear growth makes 100% sense and it continues forever. Real estate agents that didn’t even need to graduate from high school keep saying that so obviously it’s true.

Montreal has negative population growth but immigrants will keep moving there even if they can’t find jobs and home prices are overpriced. The whole investment thesis hinges on immigrants having no other option than to raise the value of my home. Sounds foolproof tbh.

BMO realizes when the dung hits the fan, someone’s going to be holding the bag on these real estate investment properties. Hopefully they take their own advice and loan money for these investments prudently and perhaps help in slowing this mess.

Cottage Country in the Peterborough and Lindsay area, has seen property values doubling since the pandemic started. 3 season Lake side Hunt cabins in the woods on a small lake are going for over $500K with nothing more than 4 walls made of pine board built in the sixties. Any lake side cottage with vaulted ceilings over $1M, including 3 season places.

Houses in Peterborough and Lindsay have also doubled. Post WW2 War time houses over $500K.

Many of cottages were bought to turn into rental investments, and are turning cottaging at the lake to a Florida spring break party location, ruining it for the people that have owned the cottages for generations.

Hope the lunacy ends soon, and the real estate investors pay the piper for the havoc they have caused.

Most of their economic dept are separated from their risk dept. Most will agree with whatever’s best for the bank since greater bank growth means higher economic benefits through shares.

Not quite tulip bulb mania… but close. The madness of crowds.

I said it before, and I’ll repeat it again.

Now that residential real estate has been financialized and considering how far out valuations are, we may be surprised at how fragile and sensitive Canadian real estate has become.

A very large number of dwellings are now investor-owned (rather than end-user owned) and they own for two reasons only – expected appreciation and steady fixed cash flow – and both are linked to valuation/price. If an initial price decline occurs and a new trend downward appears imminent, many owners of investor-owned dwellings would be very motivated to sell (and may move quick).

Pile other potential sellers/holdouts on top of that – retirees or near-retirees looking for top dollar; those who bought too much house in the last few years and worried about being underwater; possible casualties if a recession ensues; etc. – and there could be quite a waterfall of new listings.

Suddenly, we’ll see that supply was never the issue! It was house hoarding & holding out (caused by policies that produced a ‘never can lose’ market psychology) that lead to ever lower turnover. TURNOVER is the issue leading to extreme imbalances – everyone wants to hold onto the golden goose (or do anything to get one!)…until it becomes rotten and not so golden.

At the same time, a larger than normal amount of future local end-user demand was pulled forward due to FOMO.

Once new listings start to grow (Note- actual new supply is already significant and more than meeting demand), investor demand starts to wane (and reverses into selling), and local end-user demand diminishes since so much was pulled forward, prices will likely erode and potentially more quickly than one would expect for real estate. Any interested buyers are likely to ‘stand back’ as prices drop to find their new fair equilibrium that is better supported by fundamentals.

In all this, a persistent level of consumer inflation will likely impede the usual options of “massive fiscal injections” or “dropping rates to .25%”, especially if the rest of the world is in less dire straits.

Never before in the history of humankind has a bubble continued indefinitely. This time will be no different. Eventually, these sorts of imbalances can’t be continued and the elastic will snap back. The big question is – when might this happen?? Keep your nose in the air.

Landlords live in the belief their property is worth more than what the market can bear. In most cities, renters are 50 % of the population. Renters ( i.e. taxpayers, students, low-income elderly, etc.) are being stiffed every month based on the landlord’s perception that they’re are the king of the real estate hill. And they needn’t maintain the building they own – evict the complainers, as their rental unit is worth another 50%.

Agent Bob

I have worked as a real estate broker for over 40 years and there has never been more insanity in housing than right now.

The real causes of this unhealthy market are not being discussed or acted upon and the government is complicit in this mess.

Yes. Some people are raising the issue that investors right now are buying up 25% of all real estate in Canada but the government has not done anything about it. Like New Zealand Investors should not be able to write off mortgage interest or be allowed many other tax write offs. They should also be charged a minimum of 3% of the value of the property in tax each year. That will dampen the mood for buying up a lot of supply which they then will rent out at exorbitant rents.

Agent Bob,

Also. It has been reported by Transparency International Canada, an agency that is part of the Global coalition against corruption, that up to 130 billion is laundered or ‘ Snow Washed’ here every year with much of that going into real estate. These criminals don’t care if they pay tens if not hundreds of thousands more than what a property is worth to end up with clean money.

over 56 other countries have very strict laws and methods of identifying cases to stop this insidious problem.

The Canadian government has left policing up to real estate agents and lawyers.

Obviously, this won’t work.

Another point. Non-residents have bought up much more real estate in Canada than mentioned by government institutions. I have seen it on the ground working in real estate. It is just not being reported.

The government said they would put a 2 year moratorium on non- resident buying by this past January. They have not done so. I believe this is one of the main drivers of the 20 to 25% increases in price I have seen in many areas over just the past 2 months. Yes. 20 to 25% increase in 2 months. people from all over the world are trying to get in before the door is shut. Shut it!

There is no housing shortage, just the detached single family type of housing is in high demand because that is what most people want. There are three 1,500 sq. ft very recently high quality renovated condos with 2 parking spaces each in the 10 story building I am in that are relatively reasonably priced compared to condos in other buildings very nearby and they haven’t sold since they were first listed over 3 months ago and re-listed at least twice.

To ignore the shortage is silly…

We are more than half a million units short and growing.

Try to build a home now.. forget that try to buy a new vehicle. I did a simple Reno last year and couldn’t get 4” abs.

Look at the competition for rentals/purchases. Many people sold last year and are trying to get back in. These people have over $1m cash sitting collecting 0% interest, or in the market at all time price/earnings ratios. Landlords have been taken advantage over the past couple years resulting in less rentals on the market.

You can directly blame government… but many people get fed MSM and would rather blame a freedom supporter. The government is the issue.

And I was paying $80 for a sheet of 3/4” plywood.

Many people living with their parents or with roommates (some sharing rooms), and many of them are saying that there isn’t a supply issue… if they can’t see that isn’t the definition of a supply issue, I don’t know how else to get them to change their mind.

MSM and Trudeau misrepresents these protests, yet their supporters eat up everything their told. The queen is 95yrs old and is easily beating convid. This isn’t and has never been about a virus… if you have to question what this has to do with the article, you need to learn how to think.

Have a great 2022! It’s going to be awesome!

Have mixed opinions on this article and the various comments, but I do totally agree that prices appear to have risen much more dramatically in smaller communities. To cite a real example, March 2020 we “purchased” in Stratford, Ontario, a 25 year old bungalow, three bedrooms, two car garage, needed refreshing, but overall great home, price $474k. No real competition either. In the end we had to back out of the purchase for personal reasons. So now we are back looking and we see, if you can find one, similar homes, some not as nice, all going over asking, blind bidding, hitting the $850k mark and higher. Newer and nicer turnkey bungalows in the area are going for $1.2million. Madness, greed, what is it? Supply-demand? Foreign residential investors? I fear the Liberal solution will be a home equity tax of some kind…… scary thought given current affairs.